With the fluctuations in the economy, talk of another housing bubble seems to be all anyone is talking about as interest rates rise and mortgage rates continue to slow down. Over the past two years alone, home prices have risen at a rapid pace. So it makes sense that some people are asking if things are just slowing down, or is there a crash coming?

There are two things we need to understand. The first is the reality of today’s housing market. And the second is what experts are saying about home prices in the coming year

The Reality of the Shift in Today’s Housing Market

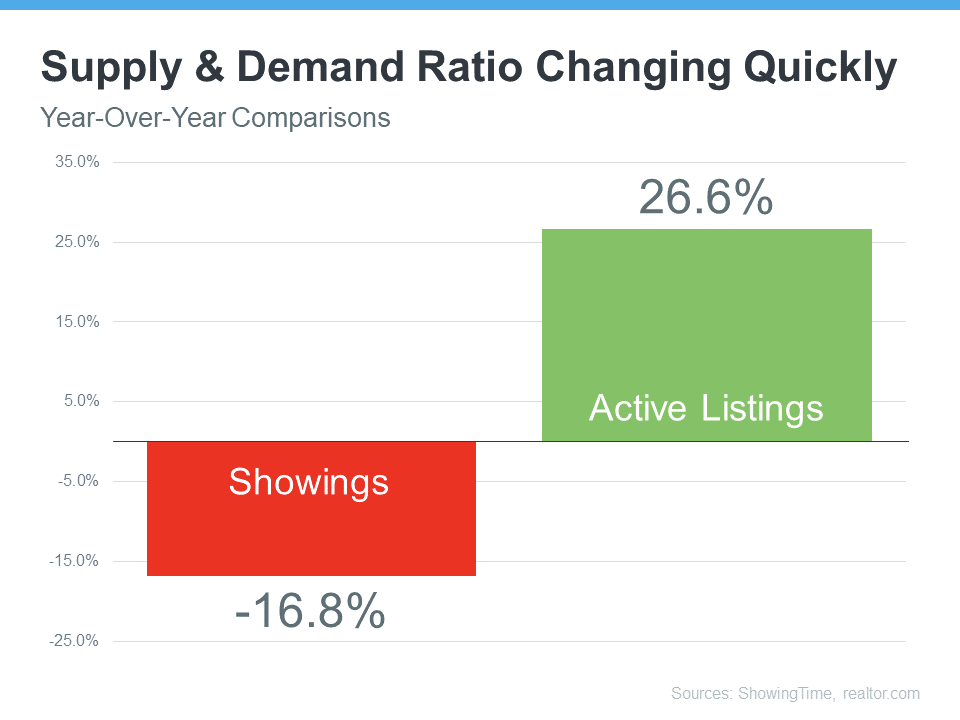

We’re starting to see a plateau in supply and demand. Active listings have increased more than 26% over last year, while showings have decreased almost 17% from last year. While this isn’t something to be overly concerned about, it’s a stark difference compared to the last two years. We’ve seen a massive amount of demand (showings) and not enough homes available for sale for the number of people that wanted to buy.

Today, supply and demand look very different, and the market is slowing down from the pace we’ve seen. This offers proof of the sudden slowdown so many people are feeling.

What Experts Are Saying About Home Prices in the Coming Year

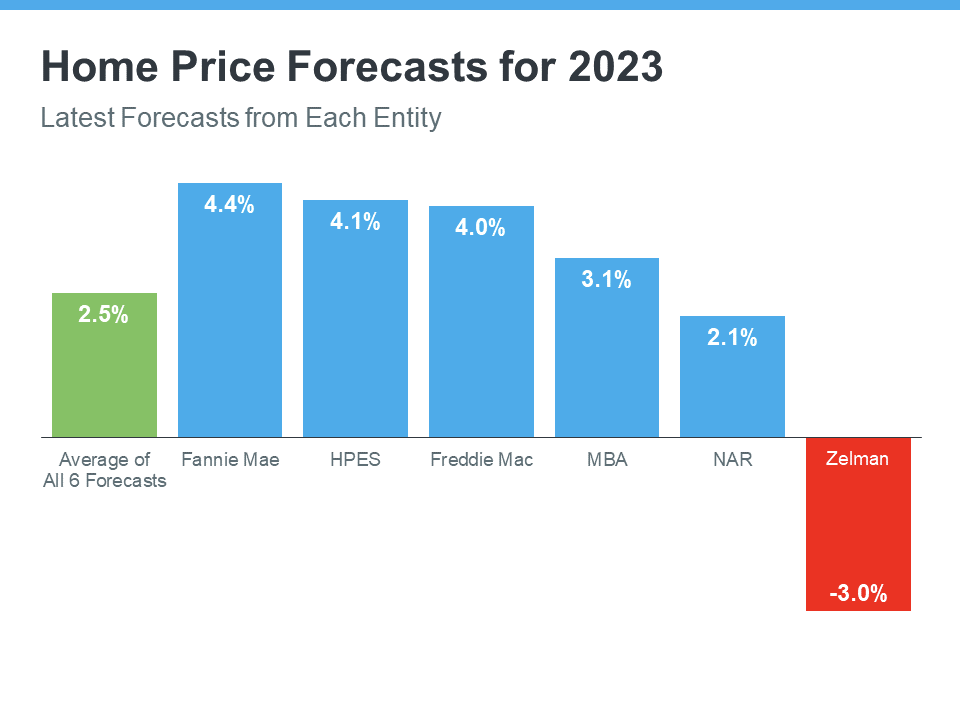

Right now, most experts are saying home prices will increase in the next year, but at a much slower pace than the last two years. The average of the six forecasters below is for national home prices to appreciate by 2.5% in the coming year. Only one of the six is calling for home prices getting lower.

When we look at what is happening along with what experts are saying, we can see the national real estate market is slowing down but is not a bubble getting ready to burst like what happened in 2008. This isn’t to say that a few overheated markets won’t experience home price depreciation, but there isn’t a case to be made for a national housing bubble.

Bottom Line

The real estate market is slowing down, and that’s causing many to fear we’re in a housing bubble. What we’ve experienced in the housing market over the past two years were historic levels of demand and constrained supply. That led to homes going up in value at a record pace. While some overheated markets may experience price depreciation in the short term, according to experts, the national real estate market will appreciate in the coming year.